Preface

The global financial crisis and the government regulations that followed it, made lending difficult. The growth in alternative systems for people to raise money was one good outcome from this. These systems included the ones that have been around for hundreds of years, such as credit unions, and the ones that are more recent, such as crowd funding, micro-credits and cryptocurrency backed cross border funding. This post discusses a type of crowd funding mechanism that has been very popular called peer to peer lending or p2p lending.

A Canadian Perspective

Even during the financial crisis of 2008, the consumer spending kept the Canadian economy stimulated – thanks to the low interest rates and rising real estate prices. After eight years, the household debt to disposable income ratio has grown to a historical high of around 170% (as in the figure on the right). This has much to do with the changing life style, as the trend of increase in domestic spending seem to be rising right from the 90’s itself. The financial crisis and fall in oil prices contributed to domestic debt further, in the form of slower growth of wages and rising unemployment (especially in the province of Alberta). This might make one wonder if the consumers would reduce their rate of domestic spending!

Although the underlying household debt has increased, the underling assets are still valuable

However, the increase in household debt ratio may not be as alarming as it seems to be. The household debt is often incurred to buy a new house or an automobile. If we consider the underlying assets (real estate) and check their current value, they might be enough to completely or partially reimburse the debt. Thus, from the economic data (as per figure 2 shown above), the debt has decreased when compared to the net worth.

However, the increase in household debt ratio may not be as alarming as it seems to be. The household debt is often incurred to buy a new house or an automobile. If we consider the underlying assets (real estate) and check their current value, they might be enough to completely or partially reimburse the debt. Thus, from the economic data (as per figure 2 shown above), the debt has decreased when compared to the net worth.

The numbers given above are just aggregates and hence can only tell the story from the point of view of an average Canadian consumer. There might be a proportion of consumers who are highly indebted. A hike in interest rate could increase the number of consumers in this category. However, as per Bank of Canada, the rates, following the positive global trend of economic growth, are less likely to change. Meanwhile, the real estate prices continue to rise, although slowly compared to the past year.

However, the major concern for the households was the ever deepening credit card bills. During the recession of 2008, the minimum payment facility of the credit cards bills became very handy when households were struggling with low income. However, the consumers continued to use this facility even after the economy started recovering. They didn’t realize that by doing so, their debt balances kept growing through interest accrual (a.k.a negative amortization). The credit card companies kept silent as it only increased the debt people owed them along with their interest income.

The major concern for Canadian households is the accumulating Credit Card interest and the consumers are looking for a quick and safe debt consolidation mechanism.

One of the ways out of the debt situation is through debt consolidation, i.e. to take another loan to pay off all the others at a lesser interest rate. However, the banks are not in a position to provide an unsecured loan (as assets might be already on mortgage) for an amount that can provides them with some relief. Same is the case for a high income individual who wants a loan, graduates from top-tier law, business or medical schools, but with very little savings and big debts.

Peer to Peer Lending

Enter Peer to Peer Lending or Online Lenders! They form a portal or an ‘online marketplace’ which connects lenders with borrowers. They identify the borrowers who are actually credit worthy (good credit history/credit score, underlying assets or high income), offer them with unsecured loans at a relatively lower interest loans. The logic is that someone who has not defaulted on a credit card interest rate of 22 percent, surely won’t default at an interest rate of 12 to 15 % charged by P2P lenders. The returns on the loan will be transferred to the lenders (or investors if you may).

P2P Lenders identified the value that traditional banks failed to capture and transformed it into a mutually beneficial arrangement for those who need money and those who had enough to spare.

The entire process is online (including the credit score calculation) and hence reduces the number of steps that a consumer usually would have to go through at a traditional bank. The P2P lenders charge an origination fee (2-5% of the loan amount) for each approved loan. As the infrastructure required for such a setup is minimal compared to the bank, these lenders are able to run at a relatively lower cost. Also, they bear less risk compared to a bank. They just transfer the risk from the borrowers to the lenders. The borrowing rate also depends upon the credit score of the borrower. The lenders and borrowers are isolated from each other. Their funds are spread across different borrowers with varying risk, like in a mutual fund. A comparison between a typical credit card debt and one from Borrowell, a leading Canadian p2p lender is shown above.

The entire process is online (including the credit score calculation) and hence reduces the number of steps that a consumer usually would have to go through at a traditional bank. The P2P lenders charge an origination fee (2-5% of the loan amount) for each approved loan. As the infrastructure required for such a setup is minimal compared to the bank, these lenders are able to run at a relatively lower cost. Also, they bear less risk compared to a bank. They just transfer the risk from the borrowers to the lenders. The borrowing rate also depends upon the credit score of the borrower. The lenders and borrowers are isolated from each other. Their funds are spread across different borrowers with varying risk, like in a mutual fund. A comparison between a typical credit card debt and one from Borrowell, a leading Canadian p2p lender is shown above.

Present Controversies and Future

The bigger traditional banks have realized the importance and significance of the growing p2p lending platforms and have decided to adapt, rather than fighting it. In US, Goldman Sachs plans to offer consumer loans online. In Canada, CIBC and Borrowell, a fast growing Canadian P2P lending platform, are collaborating to provide consumers with one click loans. In India, ICICI bank already offers a one click pre-approved loans. Although the banks claim that they are adopting to the new ‘FinTech’ culture, it actually shows the change in traditional operating models.

However, p2p lending sadly inherited some problems from the traditional banking industry and also created some new ones as well.

Lack of transperency, scope for fraud, P2P providers having no skin in the game, diminishing revenue and low entry barriers are major concerns for the future of P2P lending.

1. Transparency

In a 2014 paper titled “Banks as Secret Keepers”, economists Tri Vi Dang, Gary Gorton, Bengt Holmstrom and Guillermo Ordonez argue that banks operate most efficiently when they are opaque. High risks are usually associated with high returns. To make high returns in a highly competitive industry, banks will have to bet on risky investments which may not be appreciated by its depositors or investors. Maintaining transparency might thus became difficult and hence banks tend to hide these investments in their complex financial statements and make it hard for the depositors to find out where exactly the investments are being made. Similarly, very strict regulations tend to push the industry to find complex ways around it. Although banks do it with good intention (maximizing returns), it also leaves an opportunity for fraud and sabotage.

In case of p2p lending, the lenders do not have the information of the borrowers who borrowed money from them. The lenders will have no recourse to borrowers nor the ability to pursue the borrowers to collect the payments. The p2p lenders obligation to pay is limited to the terms and conditions agreed in the contract. A good website with an attractive story can mislead the investors into making bad decisions.

2. Fraud

I bet most of you must have seen the film ‘Big Short’, which explains a lot about what happens in Wall street. In US, when securities are created, the financial entity that creates the security will have to file a Form ABS-15G, which tells investors whether there was an independent review of the underlying loans along with the results from the review process. This requirement, for an independent third party review, was the result of the regulations that came after the recession of 2008. However, the financial entity that creates the securities can still choose not to have a third party inspect the loans either to conceal risks or to save the cost of review process. Also, cheaper third party inspectors would mean that the information provided by the borrower never gets completely verified, including the borrower’s income, employment status or homeownership. This appears to be the typical state of affairs for most deals involving loans granted by online lenders, according to economic data from United States.

3. No Skin in the game

As the p2p online lenders only form an interface that collects funds from lenders and distributes it among the borrowers, they don’t have any skin in the game. So if a borrower defaults, there is no assurance that the lender gets the money back. At the moment, the system runs based on what is called as ‘economy of trust’ similar to Airbnb or Uber. The lenders trust the platform with their money. Several of these platforms provide a limited insurance amount for the lenders. Some lenders do not allow a borrower to borrow a second loan, if the borrower already has a loan with the lender. Also, the p2p service spreads the funds from a lender across various borrowers, to minimize the risk.

Even though these measures are quite assuring, it will not be as assuring as knowing that the p2p lender itself has a stake in the game. At present, no one has any complaints as the economy is doing better and even if a minority of the borrowers default, the earnings from the majority dilutes the lenders risk and keeps them happy. However, if the economy goes through a bad time, the number of defaulters would become more and the returns from the rest of the borrowers will not be enough to compensate the lenders. Hence a strong mechanism should be in place to protect the lenders. Although this approach might take away a major piece from the p2p lending’s profitability, it might assure more stability and longevity of the business.

4. Diminishing and Unreliable Revenue Stream

The revenue of these platforms are mainly dependent on the 2-5% of the approved loan amount, also known as origination fee. This means that the revenue stream is highly dependent on the volume of new loans. The volume of new loans will dependent on whether the economy is doing well, whether the lenders are ready to invest and take the risk or whether the borrowers are off doing good and doesn’t need help. Thus it is sensitive to small market disruptions and the credit performance can change gains to losses overnight. This is observable in the financial statements of p2p lending services, where the revenue keeps decreasing as the years pass by.

5. Low entry barrier

Lately, the p2p online lending marketplace has become a very attractive proposition for the Fintech startups recently. This is mainly because of the low entry barrier. As we discussed earlier, the main source of revenue is from the origination fees when a new loan is approved. The new players as well as the existing players compete to attract more lenders by offering higher returns, for the same pool of borrowers. To make a considerable margin, the p2p lending services may have to cut costs, which includes the cost incurred in verifying a borrower and underwriting. This means that at some point, the p2p lending services will have to compromise on the quality of the borrowers (their creditworthiness, employment status, credit score etc.) and quality of underwriting for more origination fees. It gets even more riskier for the investors as the loans are unsecured. When these loans finally get securitized as debit debentures are sold in the securities market, it would result in a situation similar to sub-prime mortgage crisis.

Future

The current business model, although very ambitious, has several flaws that might result in early demise of the industry. The follows steps could help it sustain and continue to help the people who are badly in need.

- Convert the p2p lending services into a kind of ‘online only’ bank and bring it under the purview of central bank regulations, specially tailored for its operation. This would ensure lender and borrower protection. This will make the entry barrier high and reduce the malpractices in the industry to an extent.

- Expand the product offerings from just loans in an attempt to find new revenue streams.

- The P2P lender should also be a lender for the loans, which are securitized and sold them in security markets.

- Work with other p2p lending services to come up with a common standard and practice for assuring the credit worthiness of borrowers. This kind of benchmarking will improve investor confidence.

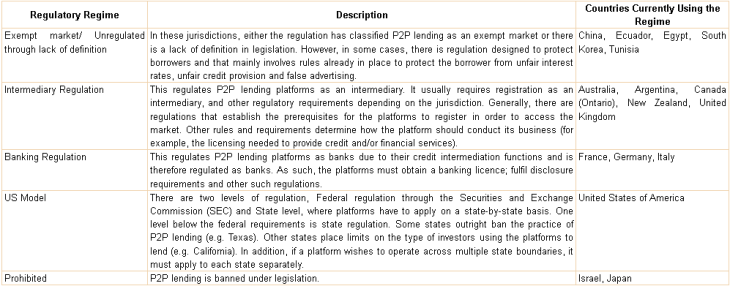

Regulations

The can of worms in the p2p lending world was opened when it was revealed that chief executive and family members of San Francisco based Lending club, one of the world’s largest p2p lenders, inappropriately borrowed from the platform. It was soon followed by strong nationwide crackdown far away in China (100$ billion industry) after similar multibillion dollar scams came to light. The regulations in UK does not consider ‘electronic lending’ as same as institutional lending or lending from banks, leaving lot of scope for fraudulence. All this calls out loud for better tailored regulations for this field.

The main arguments against stricter regulations in this field is that the field is still in its nascent stage. On one hand, the field has an undeniably positive effect on the economy. On the other hand, it is high susceptible to high risk borrowers. Too much of regulations could stifle the growth of the field at a very early stage.

But as we have learned so far, there is lot of scope for fraud. Any severe incident will only hamper the industry’s own growth and reputation. Prudential requirements such as capping the size of loans, forcing the lenders to use custodian banks, a requirement of a minimal capital security with the central bank. More should be done to ensure the lenders understand the terms and conditions and to safeguard their investments.

What it means for Canada

Overall, the p2p lending services has had a positive impact on the economy. Services such as Grow and Borrowell have been very successful. From the National Consumer Credit Trends report released by Equifax, the borrowers are able to make payments on time and reduce their debt.

As discussed earlier, the credit worthiness of Canadian borrowers is largely tied to the housing and real estate prices. We saw how the introduction of foreign buyer’s tax affected the housing prices in Vancouver. The housing prices are thus tied to foreign remittance and global market conditions. This means that the ability of borrowers to pay back the debts is indirectly dependent on global market conditions. The increasing rate of unemployment in Alberta province, related to the falling of oil price is a concern. Any changes in Interest rates, changes in US government market regulations can have an impact on the ability of borrowers to pay back. Some of these factors can be controlled by the government and central bank through their policies.

However, the most important factor that would impact is the consumer’s financial habits. No elected democratic government will have the guts to tell its citizens to live within means and the ones who have (Jimmy Carter, US) never made it in the next elections. Perhaps they should print a statutory warning on every credit cards like they do on cigarettes. Perhaps it would come to us as a self-realization.

Image courtest : https://thenextweb.com/insider/2015/07/31/crowdfunding-vs-vc-money-an-entrepreneurs-perspective/#.tnw_Q5vciQRE

References

https://rbidocs.rbi.org.in/rdocs/content/pdfs/CPERR280416.pdf

http://www.cbc.ca/news/business/house-prices-august-crea-1.3763204

http://www.cbc.ca/news/business/debt-income-ratio-record-1.3763343

https://en.wikipedia.org/wiki/Debt_consolidation

https://en.wikipedia.org/wiki/Peer-to-peer_lending

http://betakit.com/how-banks-are-making-friends-with-fintech/

https://techvibes.com/2015/06/18/borrowell-2015-06-18

https://www.rbi.org.in/scripts/bs_viewcontent.aspx?Id=3164

https://www.ft.com/content/41e706f4-d631-11e6-944b-e7eb37a6aa8e

https://ftalphaville.ft.com/2016/11/25/2180274/lending-club-should-become-a-bank-as-fast-as-it-can/

https://ftalphaville.ft.com/2015/02/19/2119569/what-will-p2p-lending-look-like-5-years-from-now/

https://ftalphaville.ft.com/2016/02/11/2152940/the-curious-state-of-uk-peer-to-peer-lending/

https://ftalphaville.ft.com/2016/03/15/2156425/dumb-money-meet-dumb-lender/

https://ftalphaville.ft.com/2016/05/16/2161949/the-online-lending-hangover-part-three/

https://canadianfinanceblog.com/borrowell-review-online-low-cost-debt-consolidation-loans/#

https://techvibes.com/2015/06/18/borrowell-2015-06-18

http://www.tradingeconomics.com/canada/interest-rate

http://www.creditcards.com/credit-card-news/minimum-credit-card-payments-1267.php

Perfectly indited articles, Really enjoyed looking at.

LikeLike